Accounting dashboard examples and reporting templates

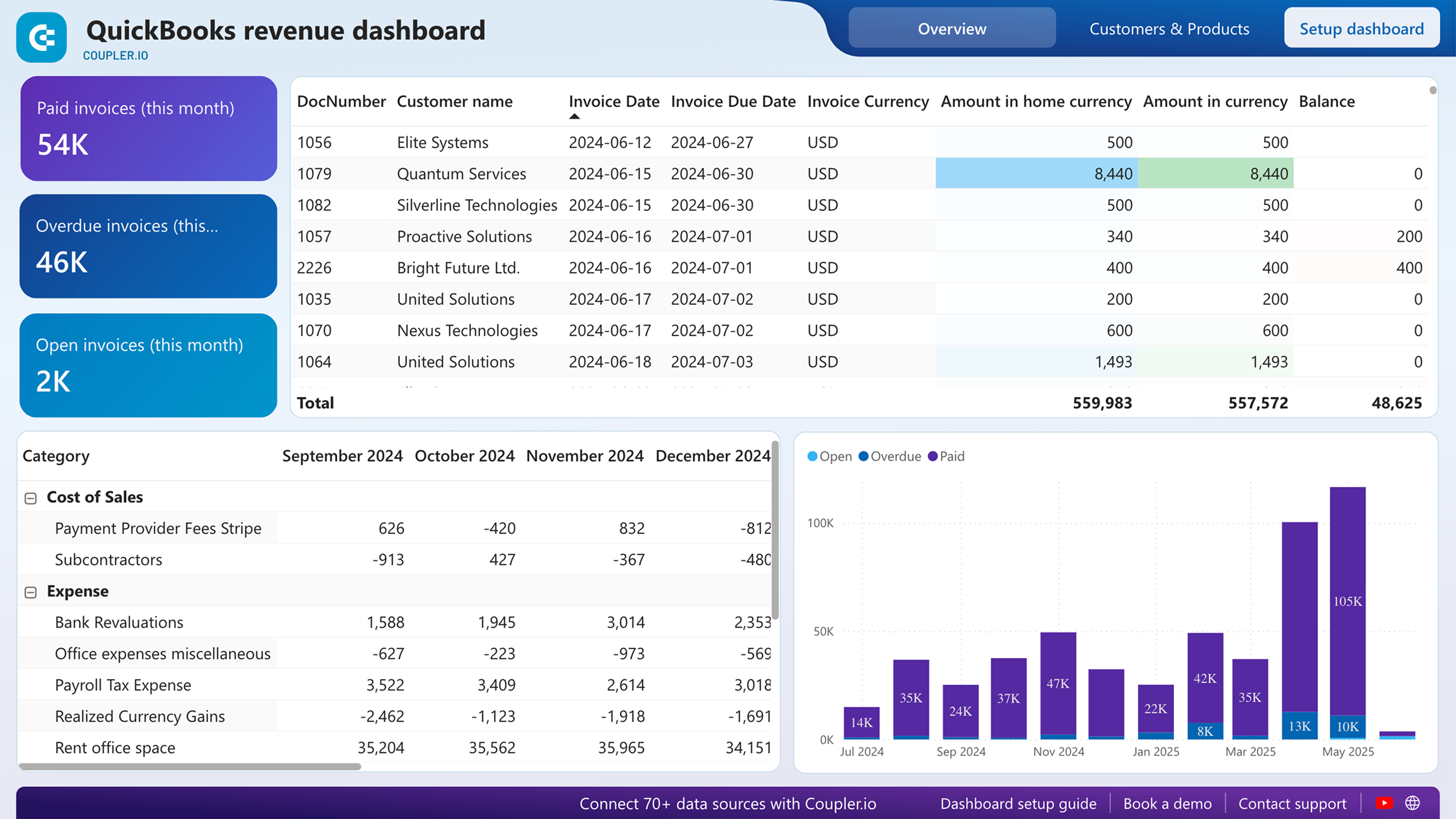

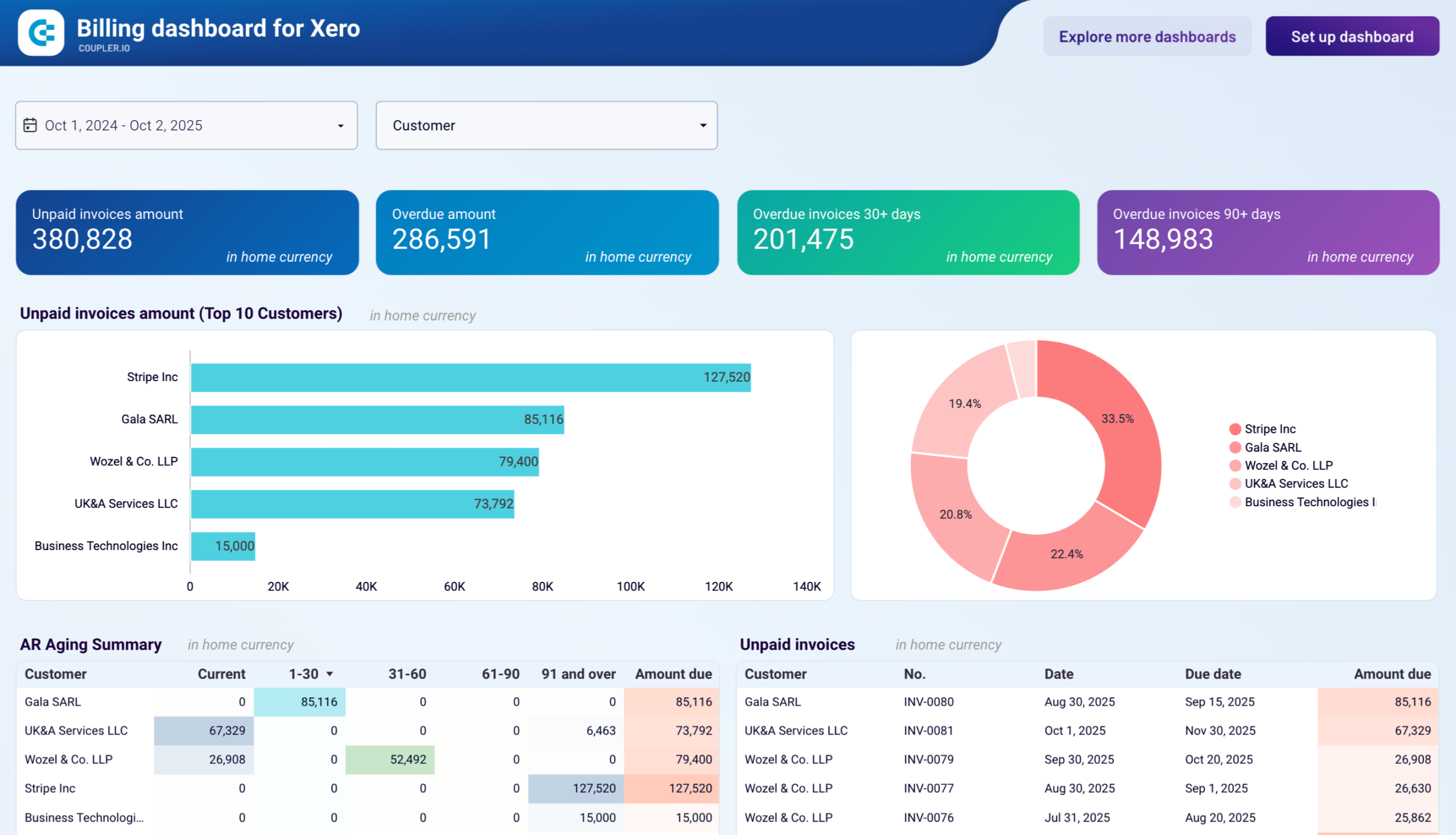

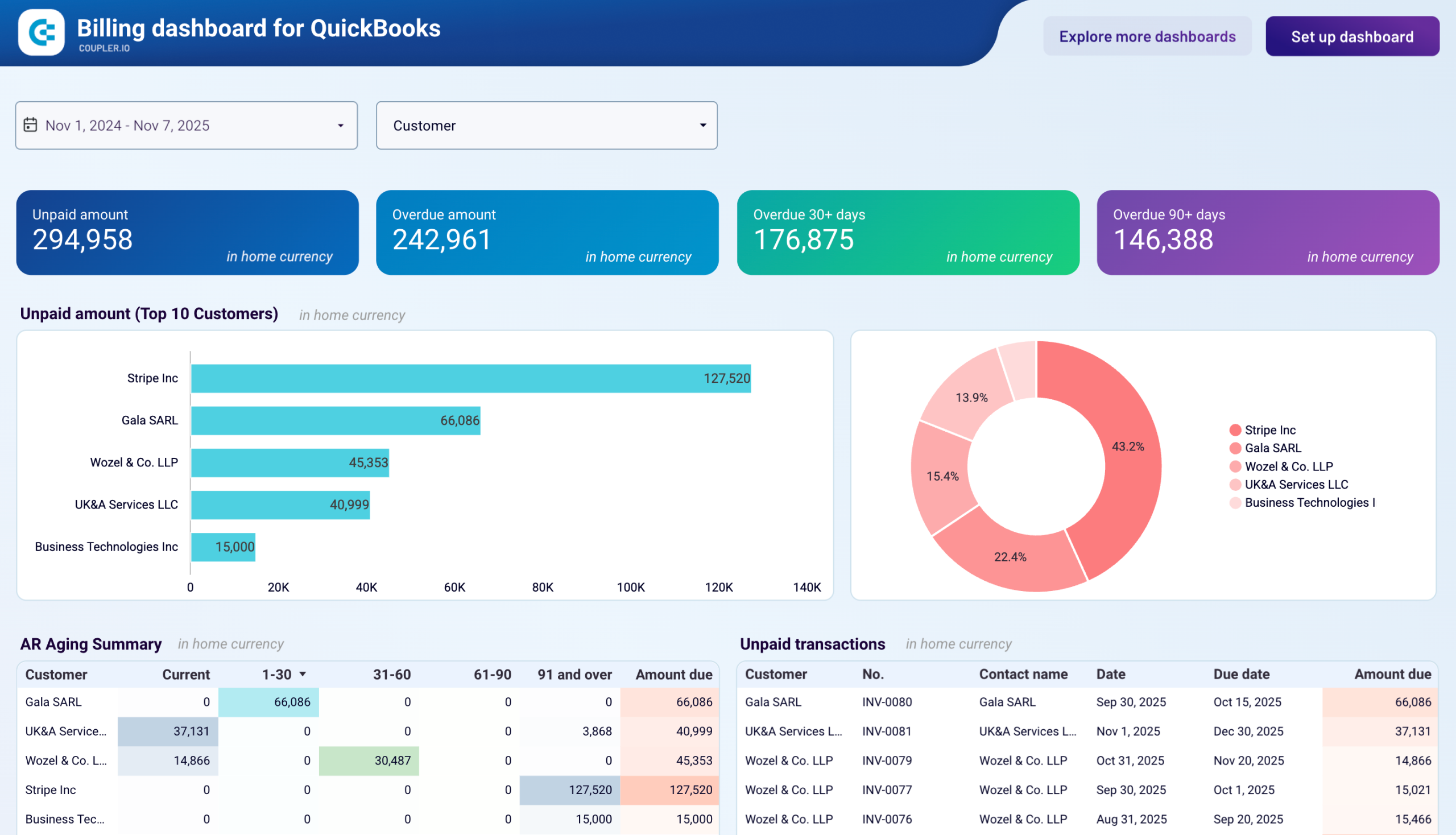

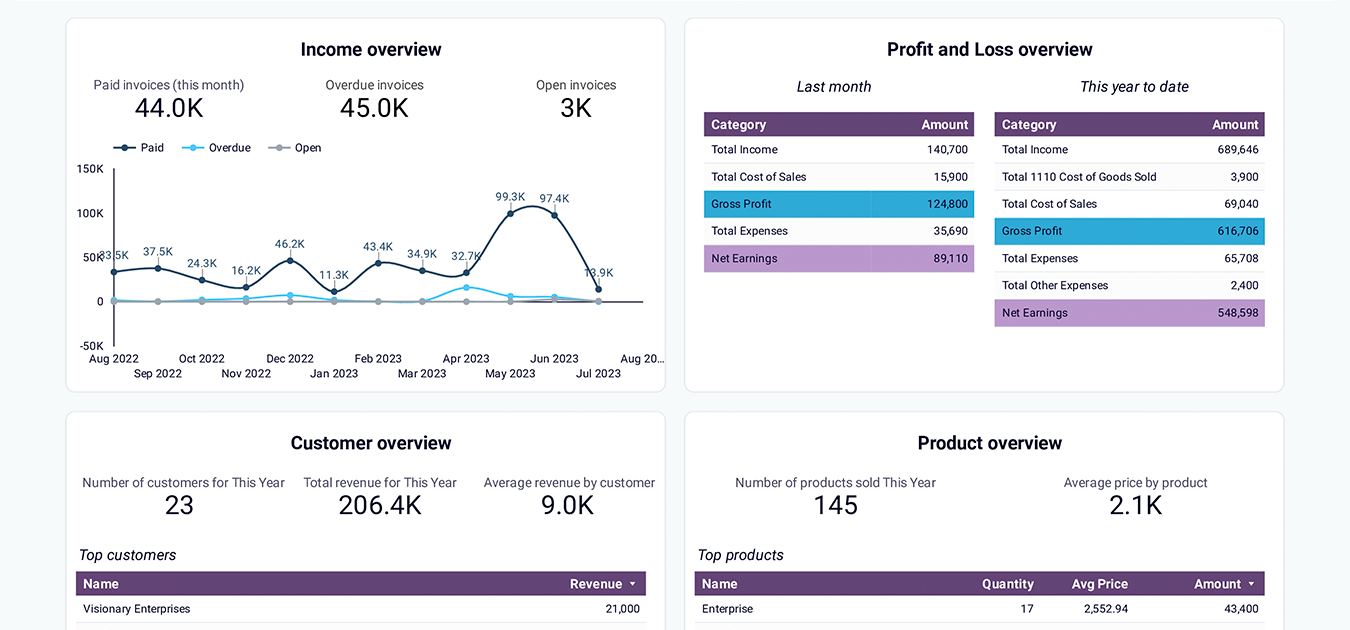

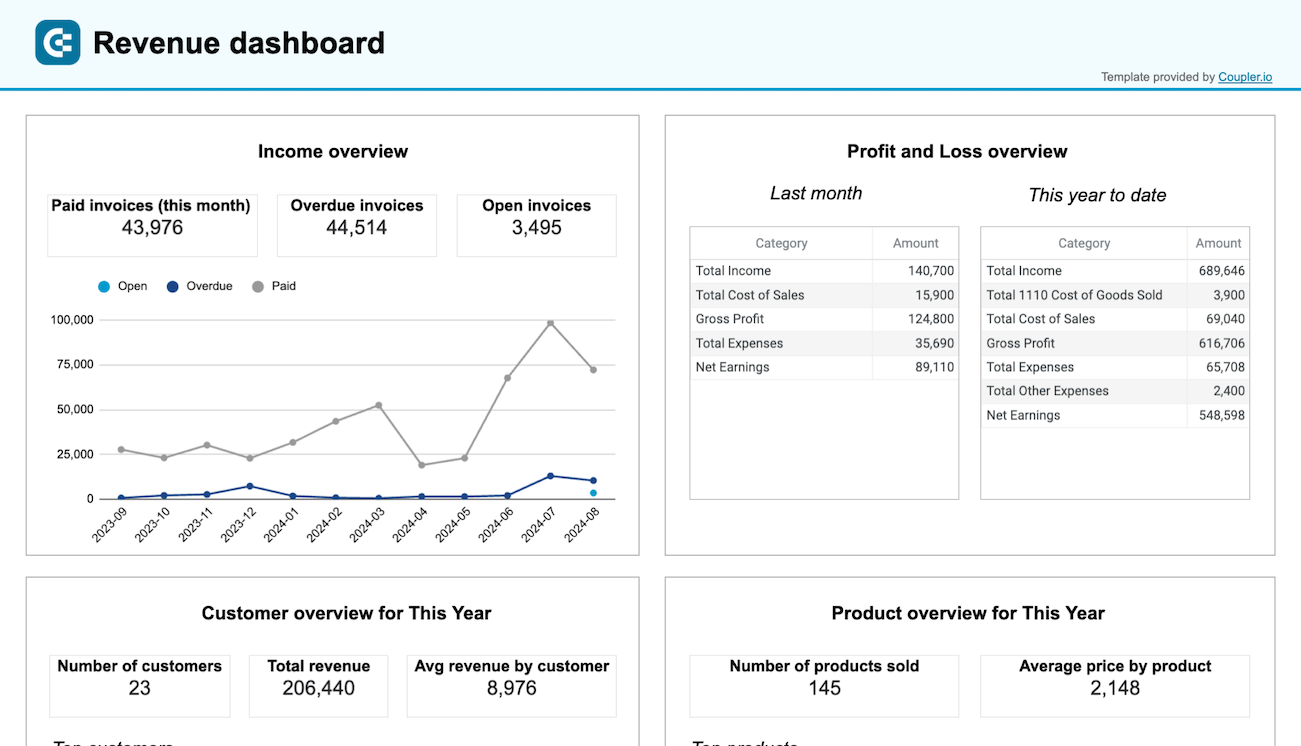

Turn your QuickBooks and Xero data into powerful financial insights with automated accounting dashboard templates. Monitor profit and loss, track cash flow, analyze balance sheets, and manage accounts receivable/payable – all in real-time, with no manual data entry required.

Accounting dashboard examples for every need

about your case. It doesn't cost you a penny 😉

What is an accounting dashboard?

By automating data collection and visualization, an accounting dashboard template eliminates manual reporting work. It also provides real-time visibility into critical financial reports such as profit and loss, cash flow, accounts receivable, and accounts payable. This enables finance professionals and business owners to make informed decisions based on up-to-date data rather than outdated reports.

Choose your Accounting dashboard template to kick off

What should be included on accounting dashboards?

A well-designed accounting dashboard should start with core financial metrics that provide a snapshot of your business health. This includes profit and loss statements showing revenue trends, expense breakdowns, and net income calculations. The balance sheet section should display current assets, liabilities, and equity positions. They help you understand your company's financial standing at a glance. These metrics should be presented both as current values and historical trends. This way, you can track performance over time and identify patterns in your financial data.

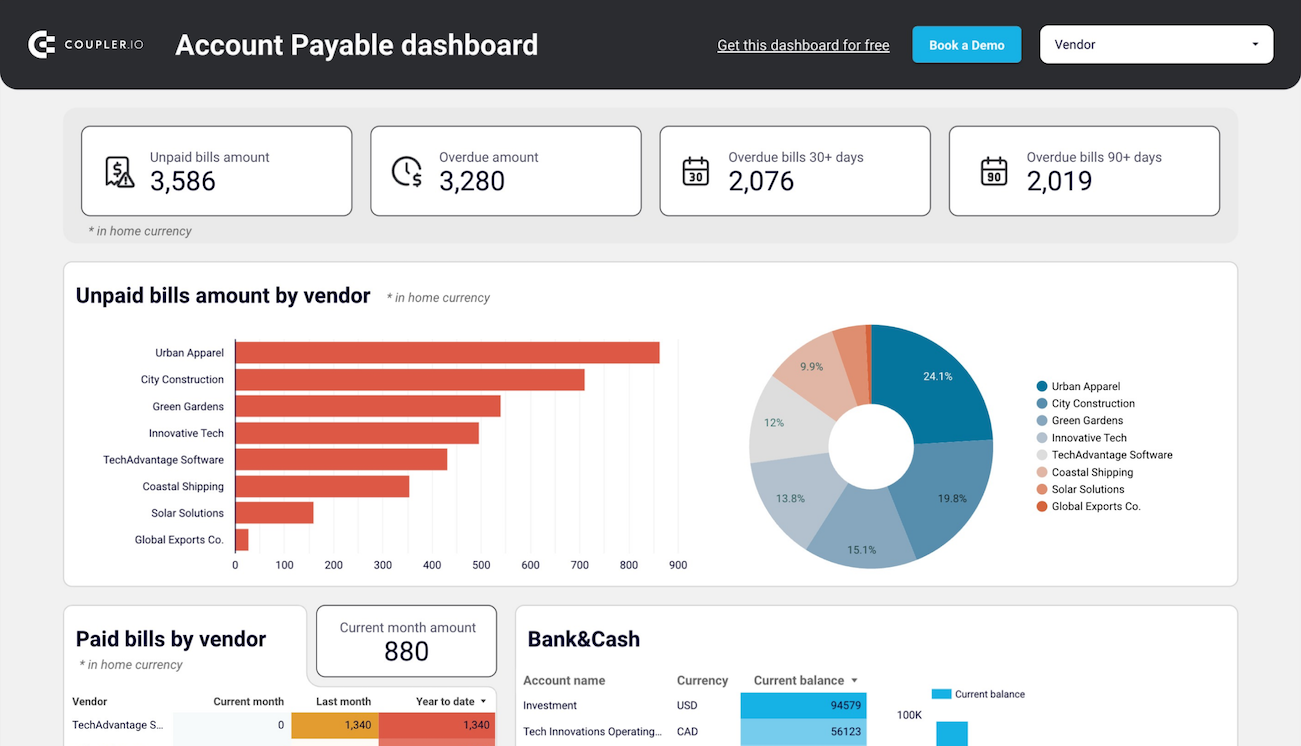

Effective cash management is crucial for business operations, so your accounting dashboard template should include a detailed cash flow analysis. This encompasses bank and cash account balances across different currencies, cash inflows and outflows tracking, and working capital monitoring. The dashboard should highlight key metrics like operating cash flow, collection periods, and liquidity ratios. This is helpful to maintain healthy cash positions and anticipate potential cash flow gaps.

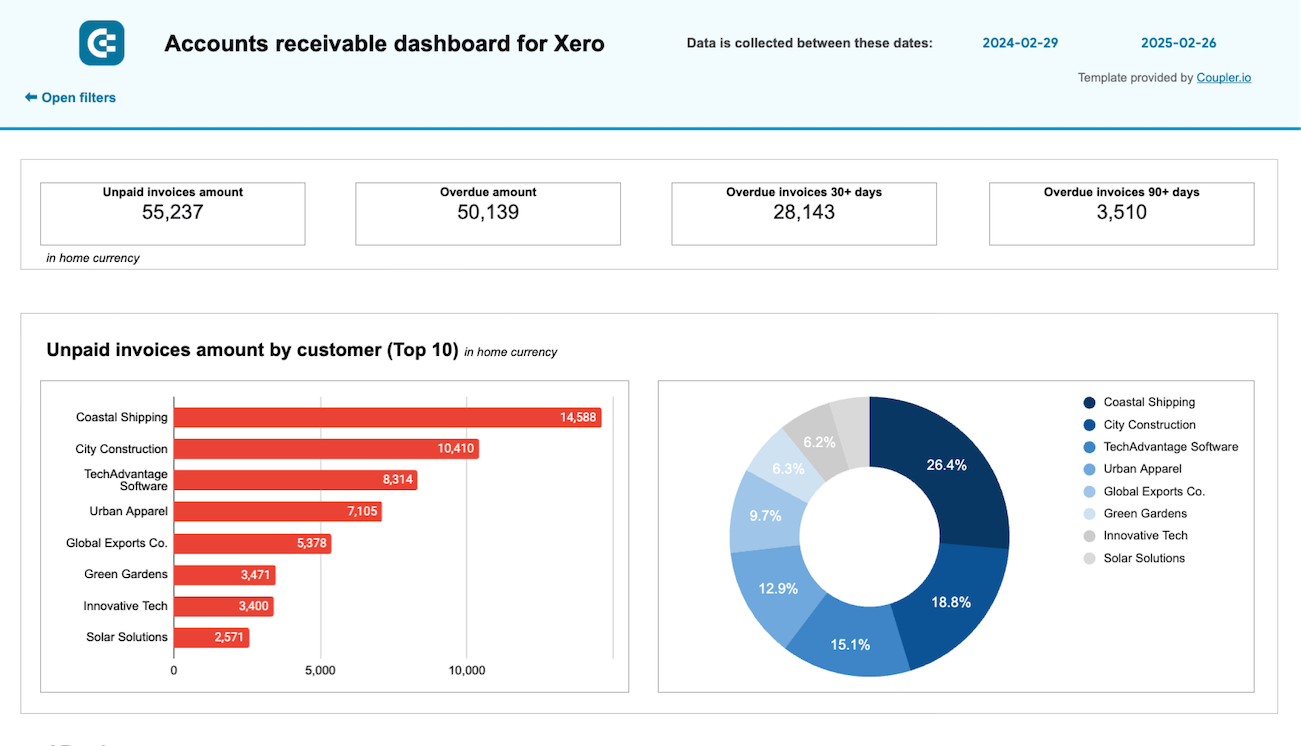

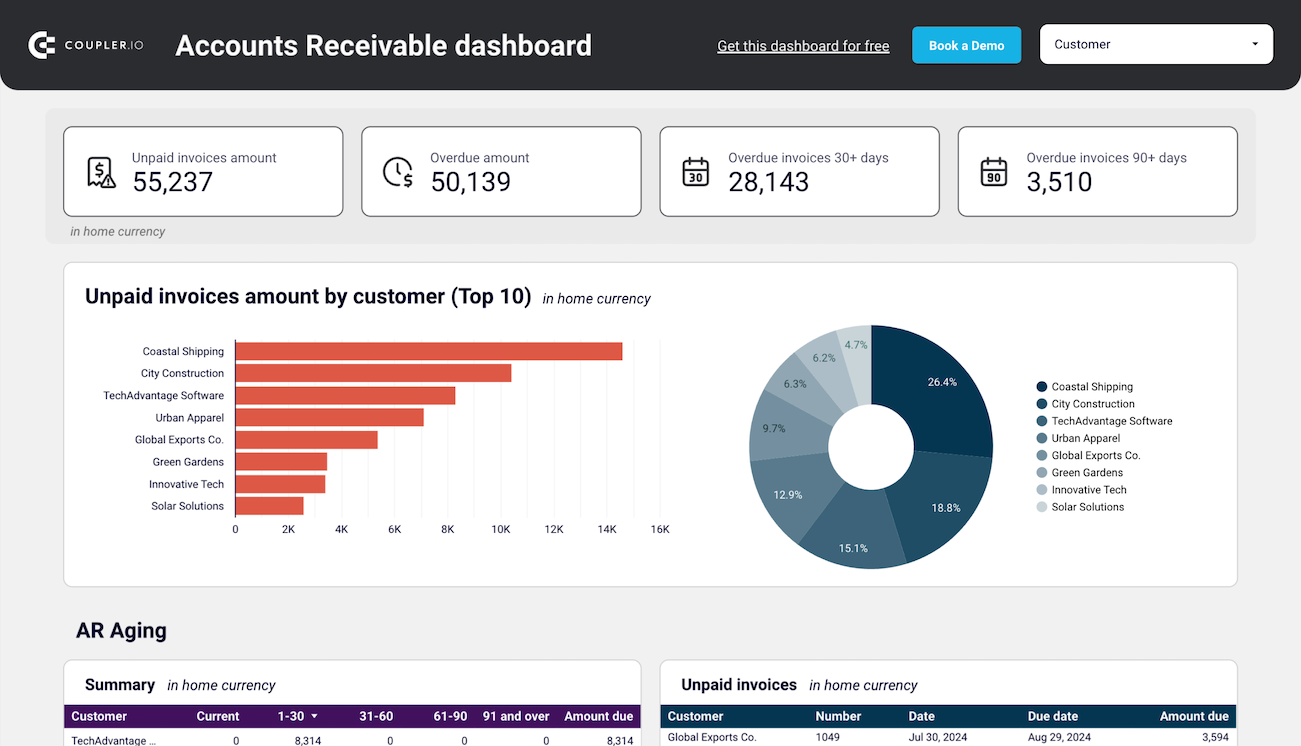

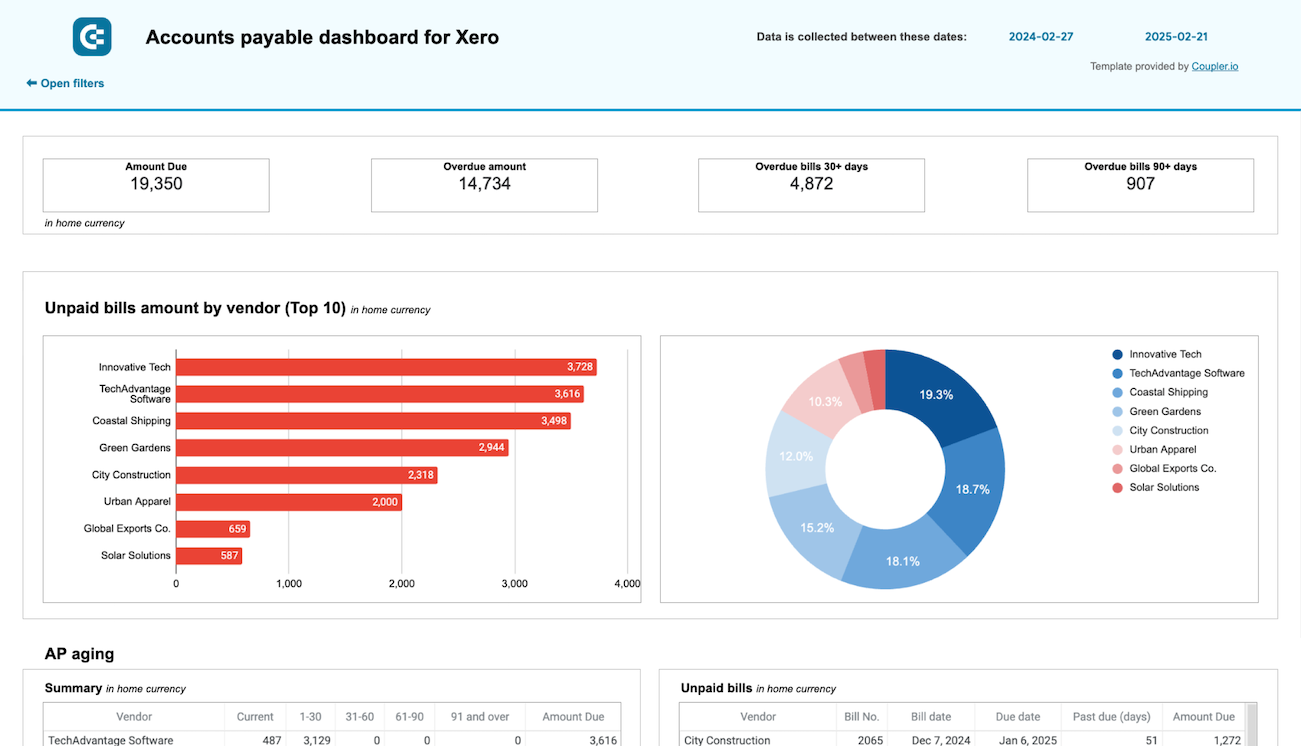

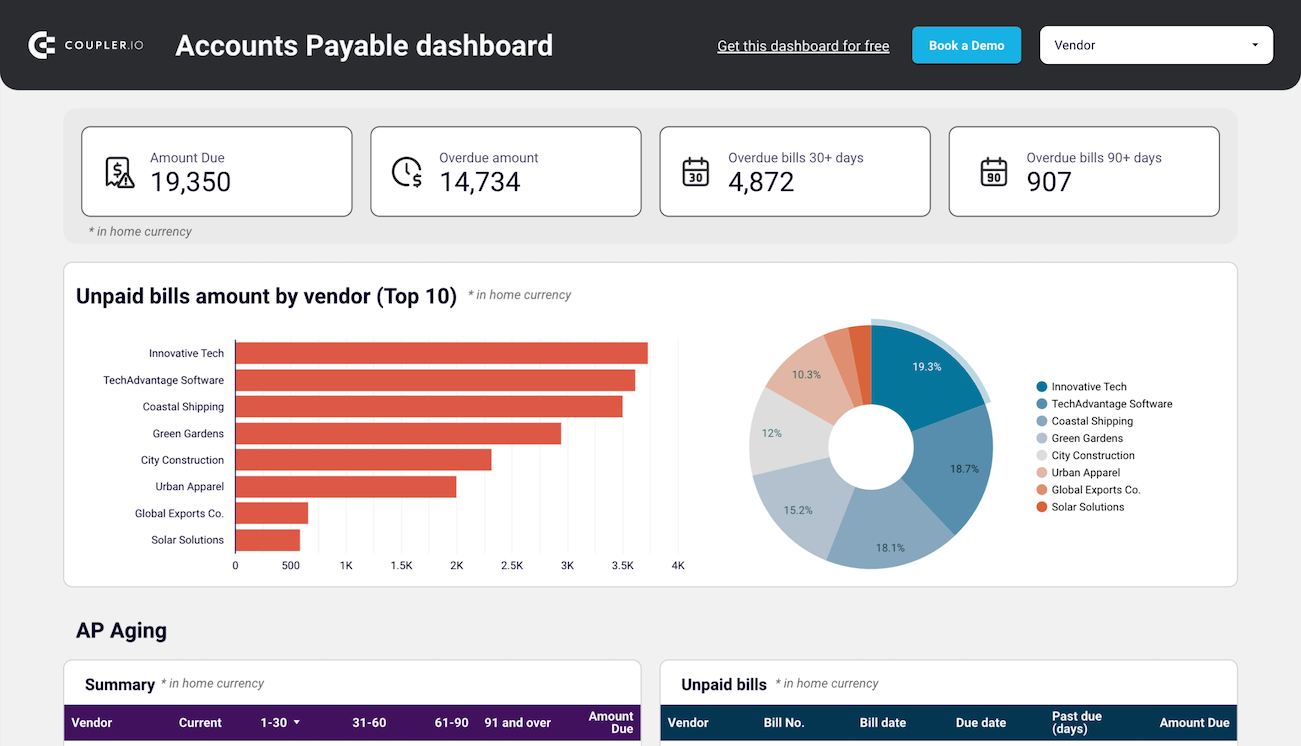

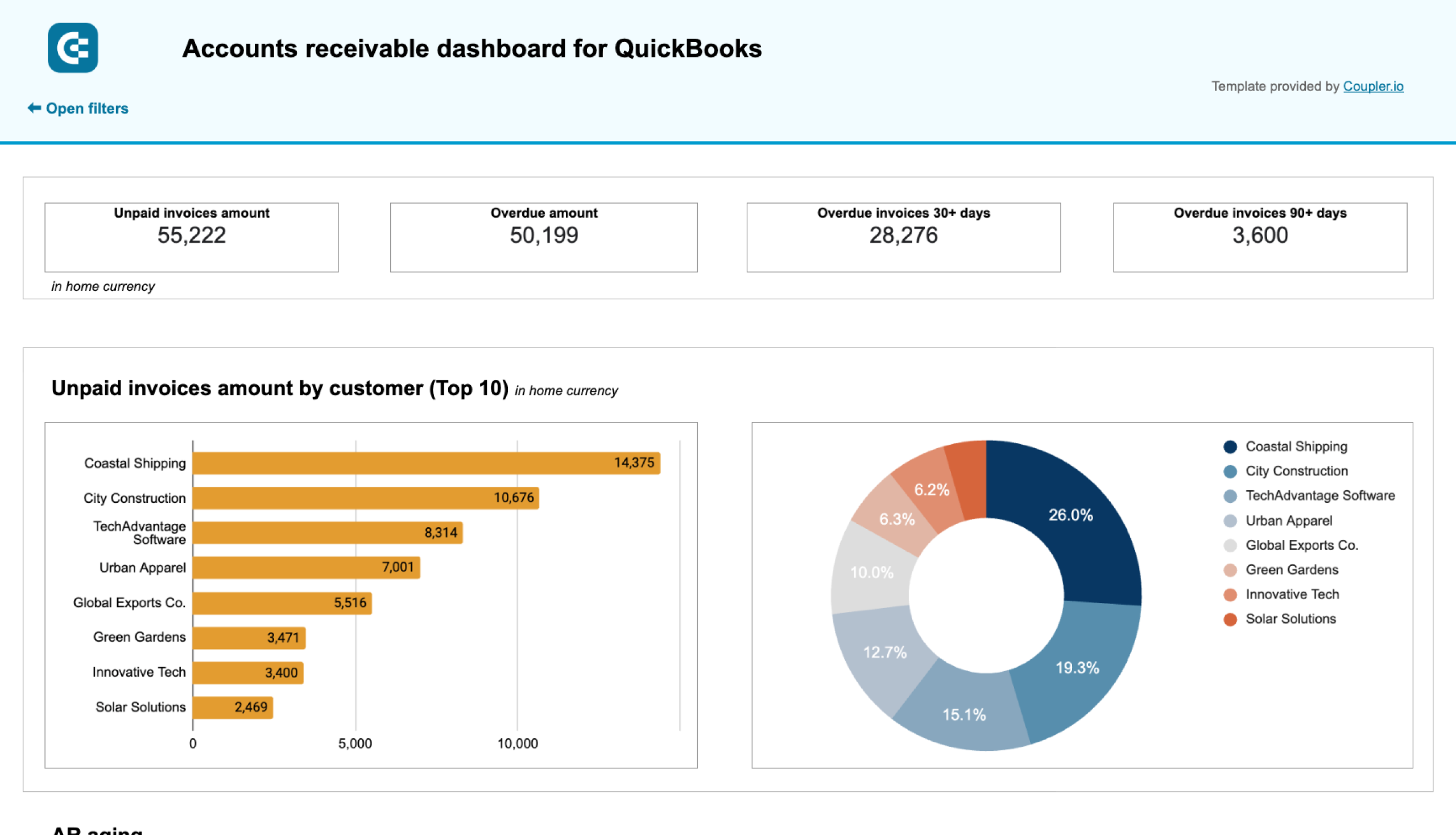

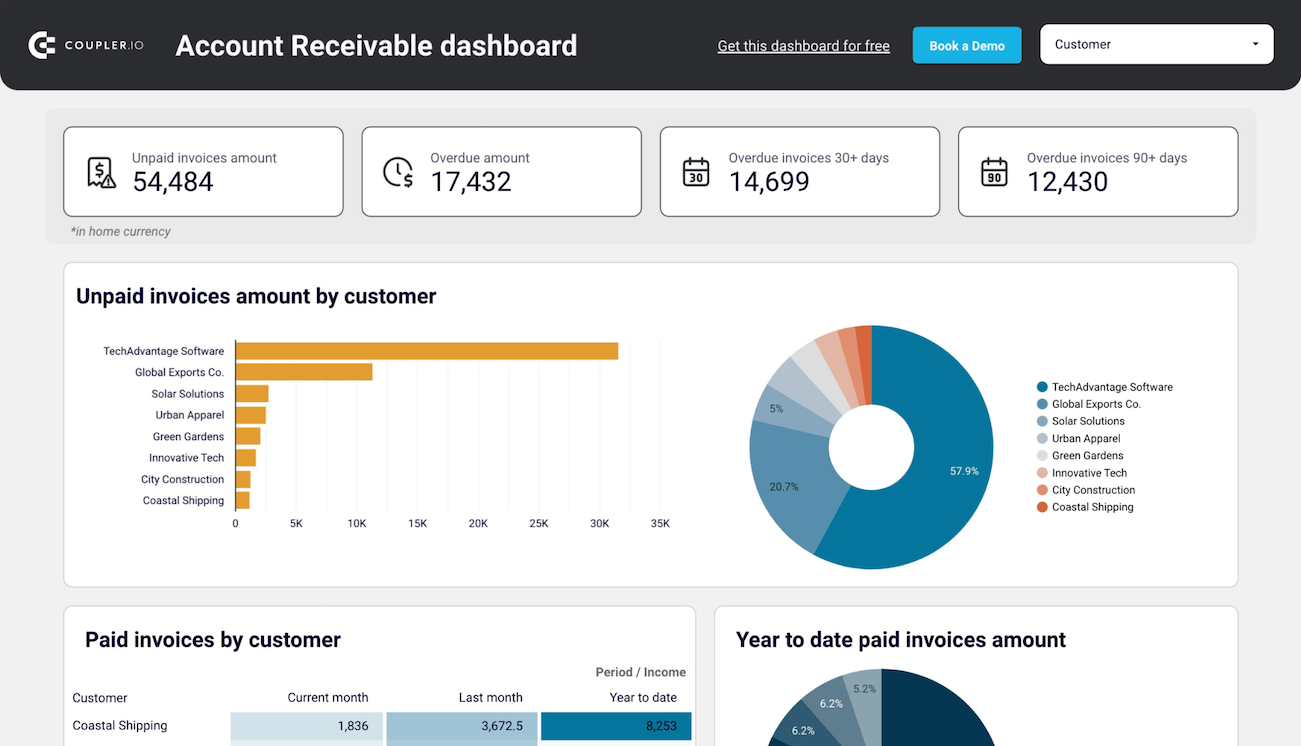

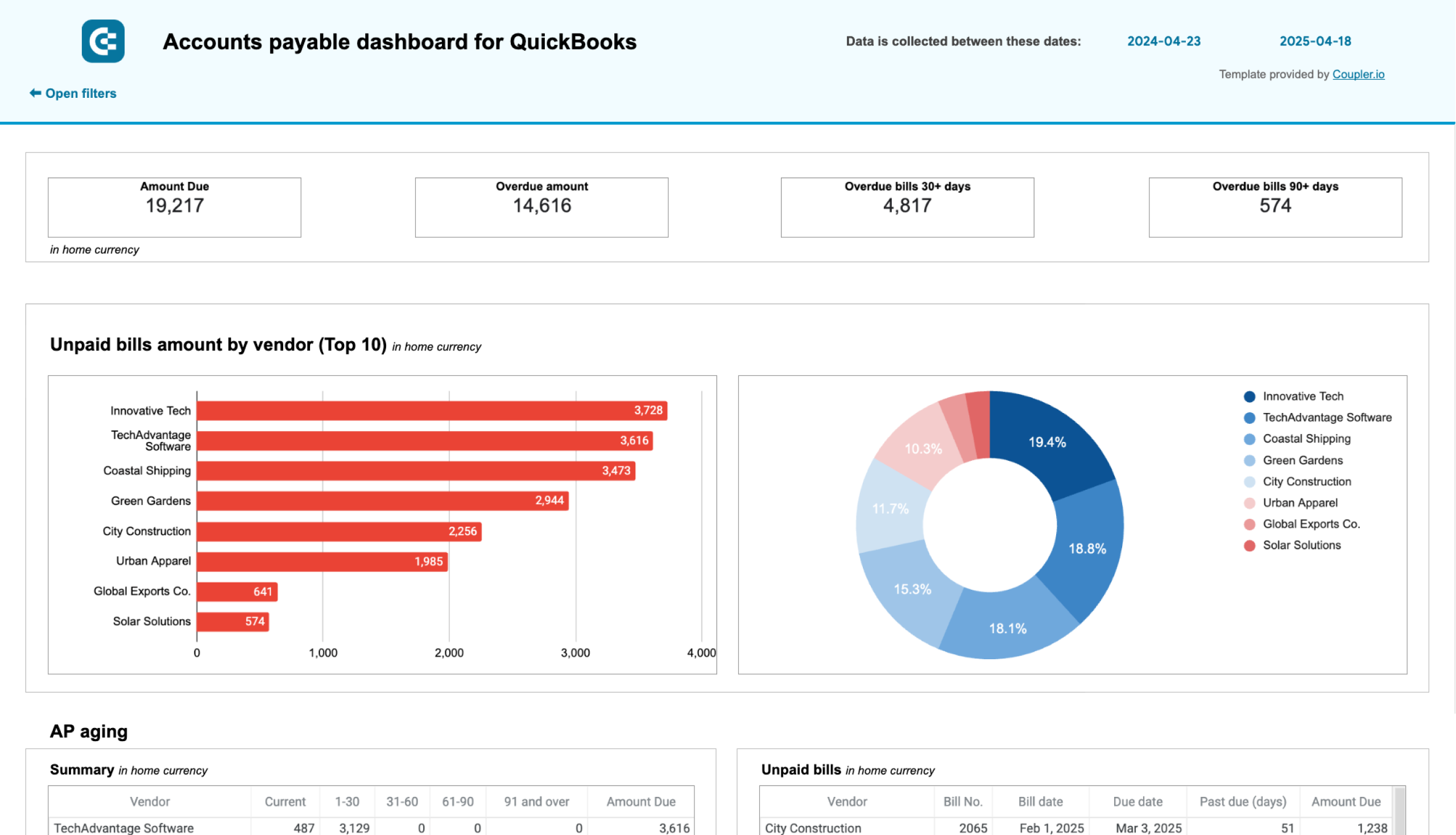

Accounting dashboards should also enable you to monitor accounts receivable and accounts payable. For receivables, this includes aging reports showing overdue amounts by customer and time period, upcoming payment schedules, and trends in collection performance. For the account payables, you need to track vendor obligations, payment deadlines, and spending patterns. These insights help optimize working capital management by balancing incoming payments with vendor obligations.

Why do you need an accounting dashboard?

Modern businesses require real-time visibility into their financial performance to make informed decisions. By implementing an accounting dashboard template, you gain instant access to key financial metrics without the need for manual data compilation. The dashboard automatically pulls data from your accounting software, whether it's QuickBooks or Xero. The data is transformed into clear visualizations that highlight trends, patterns, and potential issues in your financial data.

This automated approach not only saves time but also reduces the risk of reporting errors. It also ensures your financial analysis is always based on fresh data. With Coupler.io's automated data refresh capabilities, your accounting dashboards stay up-to-date, providing reliable insights for financial planning and decision-making.

How to choose a perfect accounting dashboard template for your needs?

Request custom dashboard

From building custom dashboards to setting up data analytics from scratch, we're here to help you succeed. Contact us to discuss your case and possible solutions

Contact us