CFO dashboard examples and reporting templates

Gain complete financial visibility with automated CFO reporting dashboards that consolidate data from QuickBooks or Xero. Track revenue metrics, monitor accounts payable and receivable, analyze cash flow, and make strategic decisions based on real-time insights from your accounting platforms.

CFO dashboards for every need

about your case. It doesn't cost you a penny 😉

Choose your CFO dashboard template to kick off

What is a CFO dashboard?

Modern CFO dashboards go beyond static statements and allow you to track income overviews, monitor aging accounts, analyze customer and vendor relationships, and identify payment priorities. With automated data refreshing through Coupler.io, these dashboards ensure you're always working with the most up-to-date financial information without manual data entry or consolidation. It creates a single source of truth for your financial position.

What reports should be included on a meaningful CFO dashboard?

A comprehensive CFO dashboard should include several key financial reports that provide complete visibility into your company's performance. Based on our analysis of QuickBooks and Xero-based dashboards, we recommend incorporating these four essential report types:

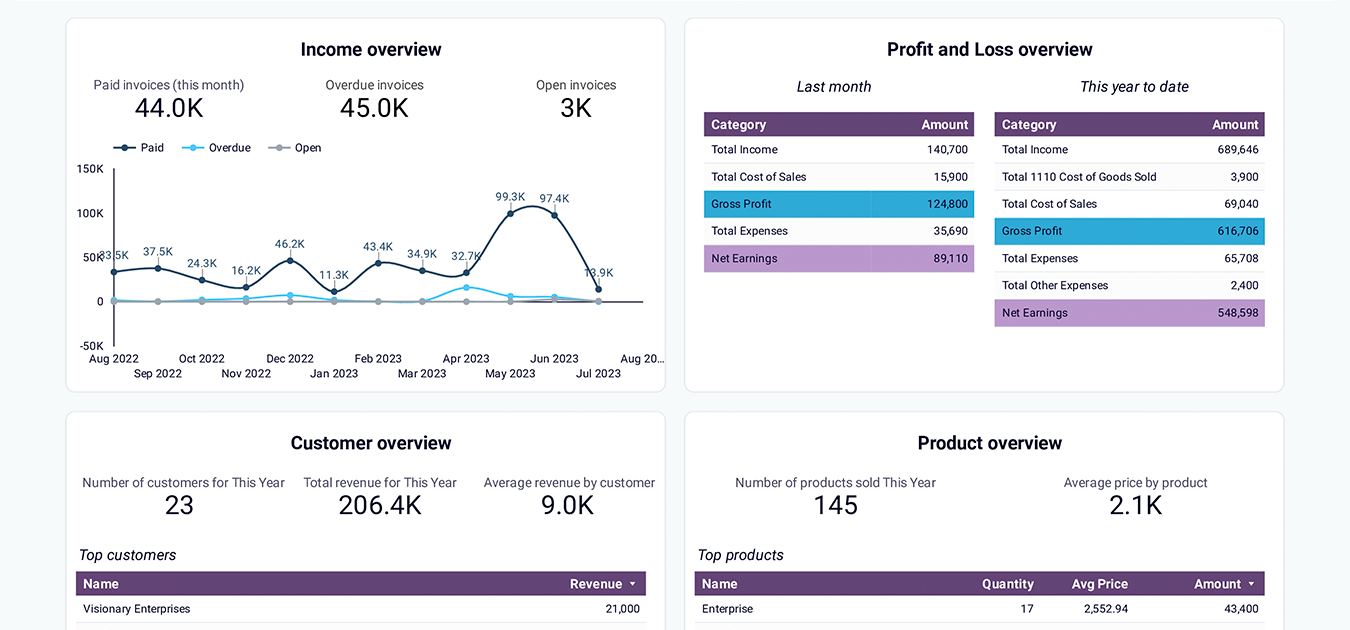

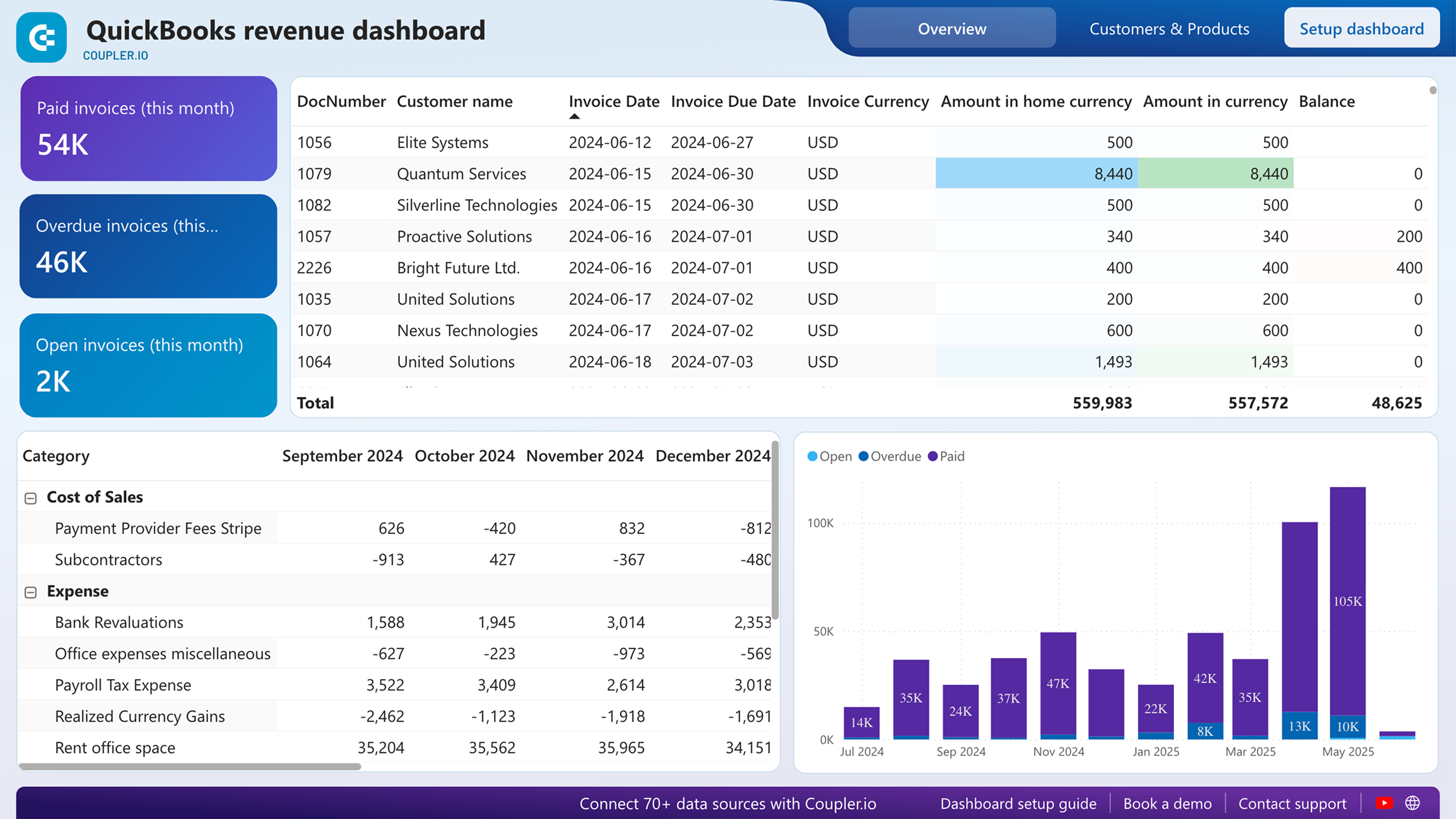

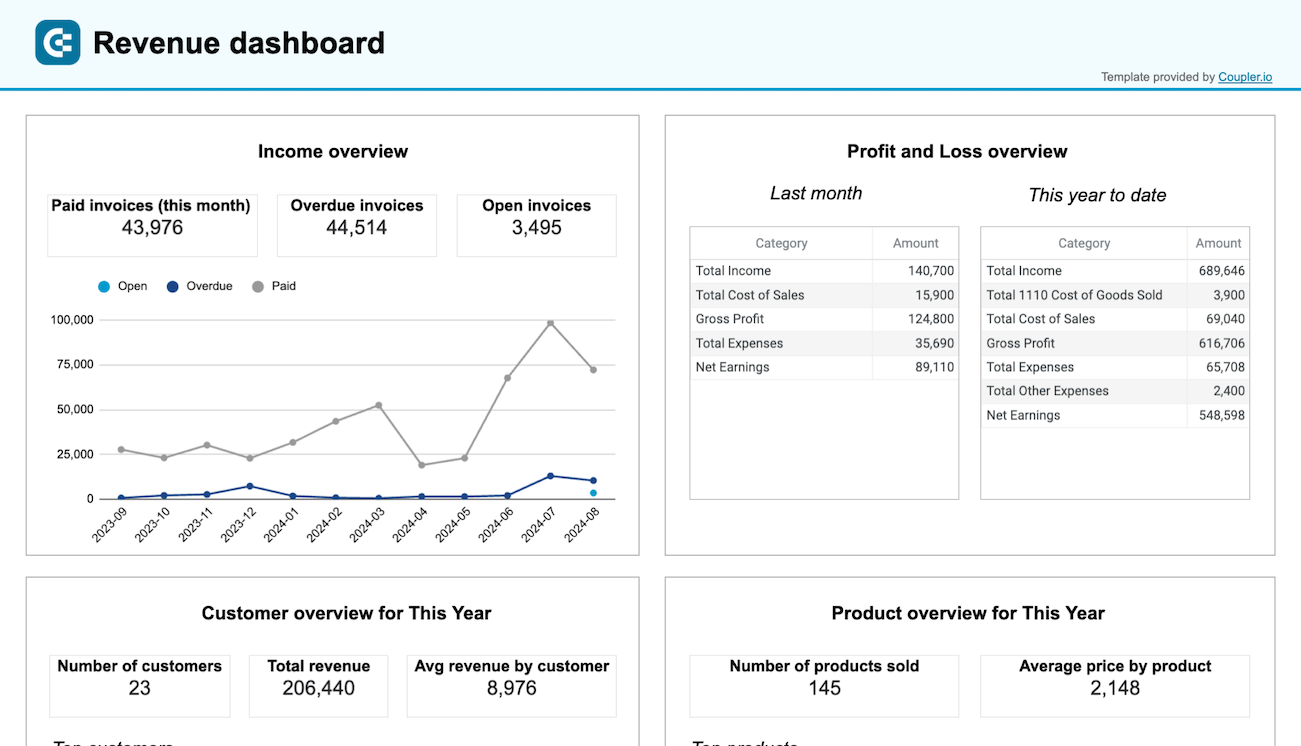

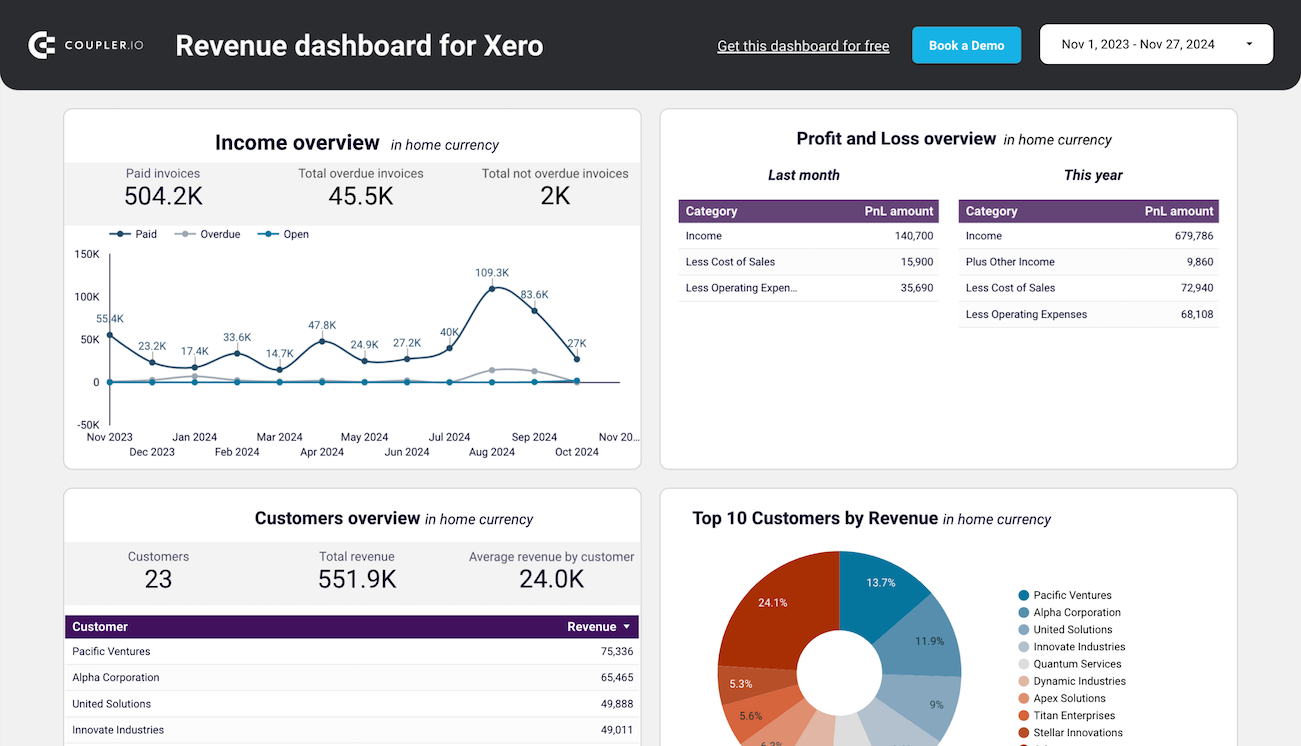

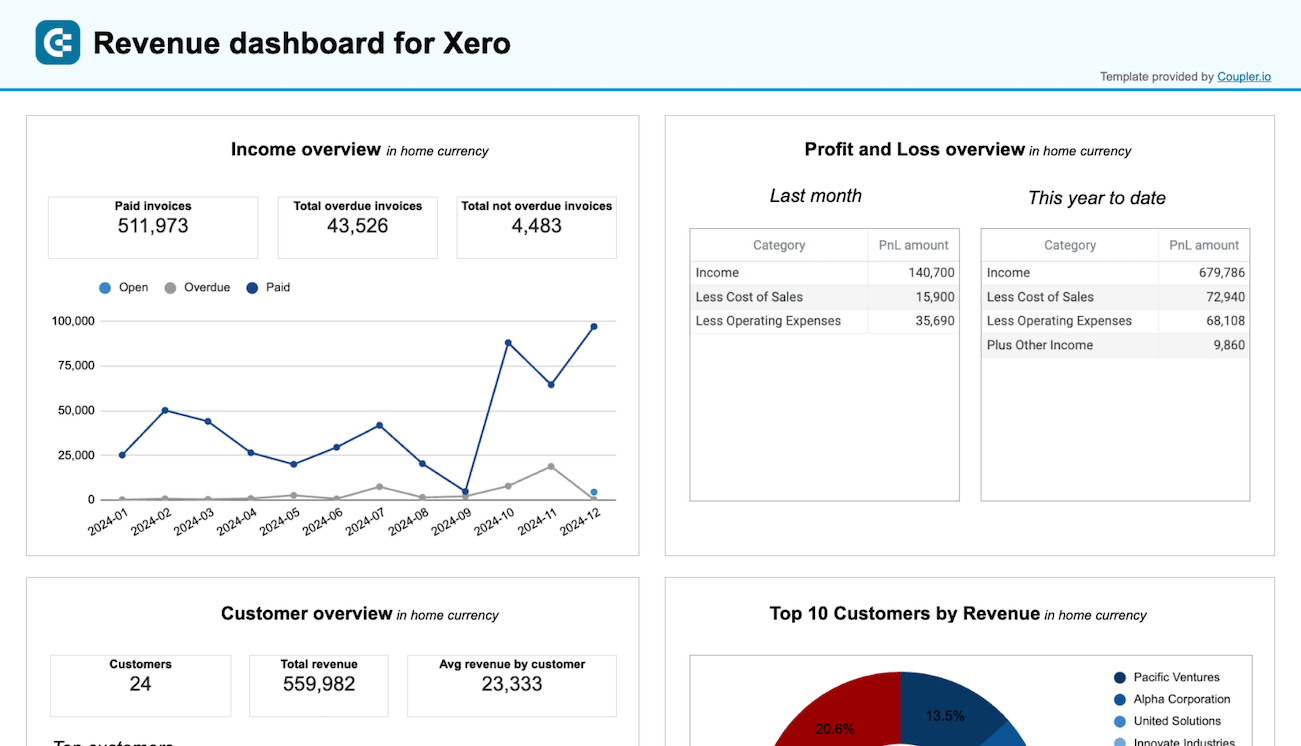

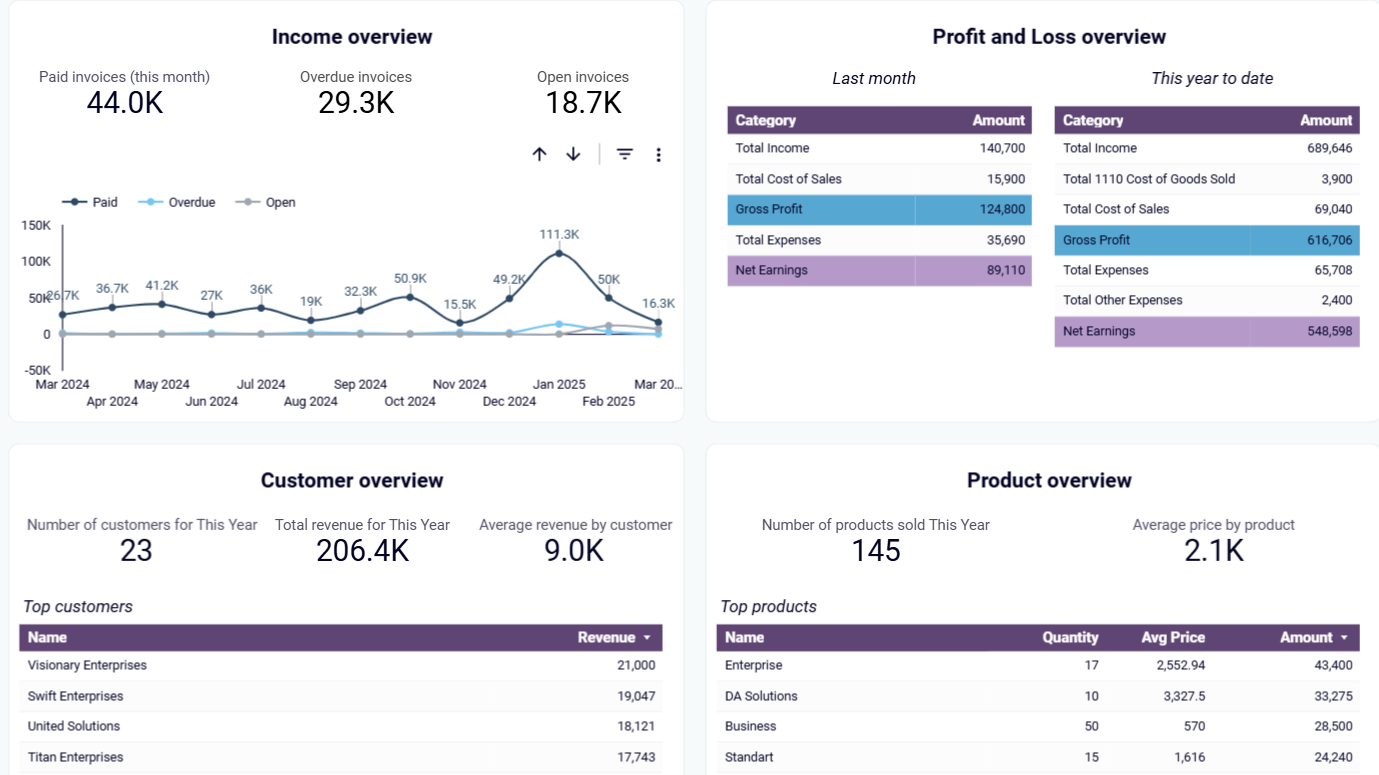

The revenue report is foundational, offering income overviews that track revenue trends across 12 months. This helps you identify seasonal fluctuations and peak periods. The report includes customer analysis showing top clients by contribution and product performance metrics highlighting your most profitable offerings. It is essential for understanding your revenue streams and optimizing sales strategies.

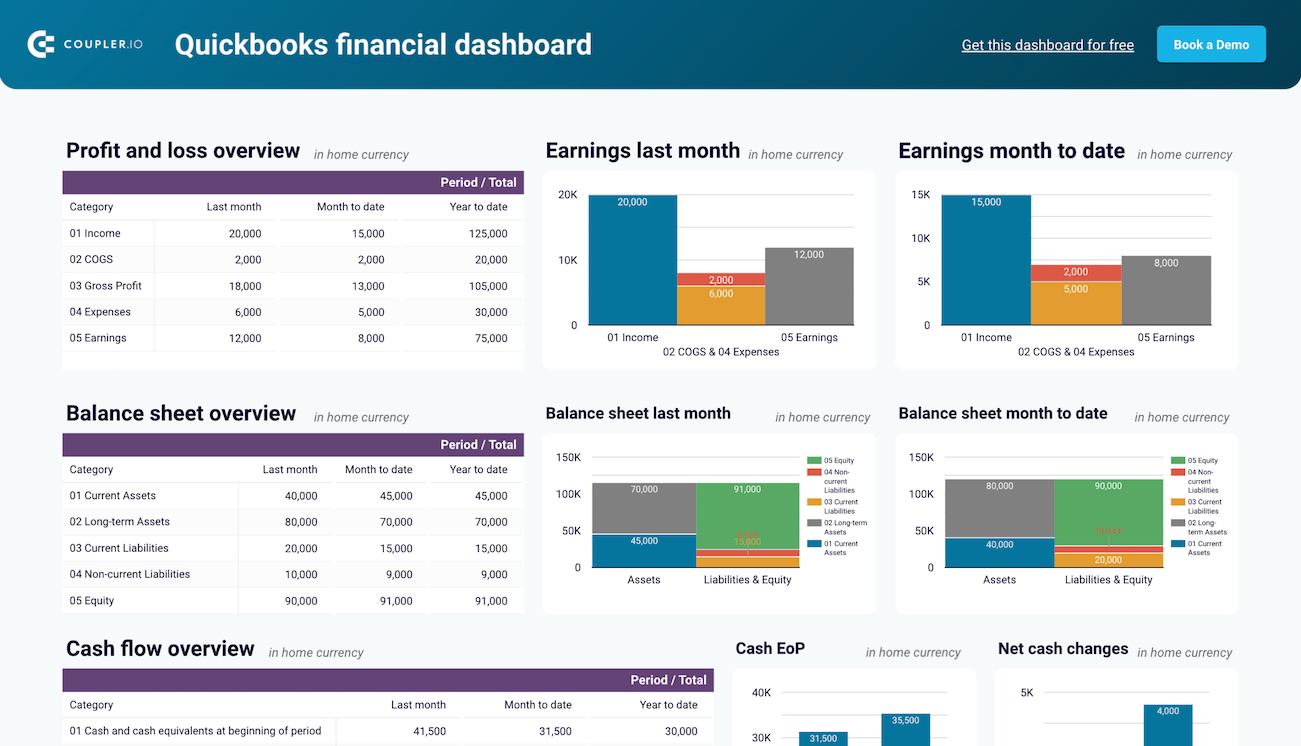

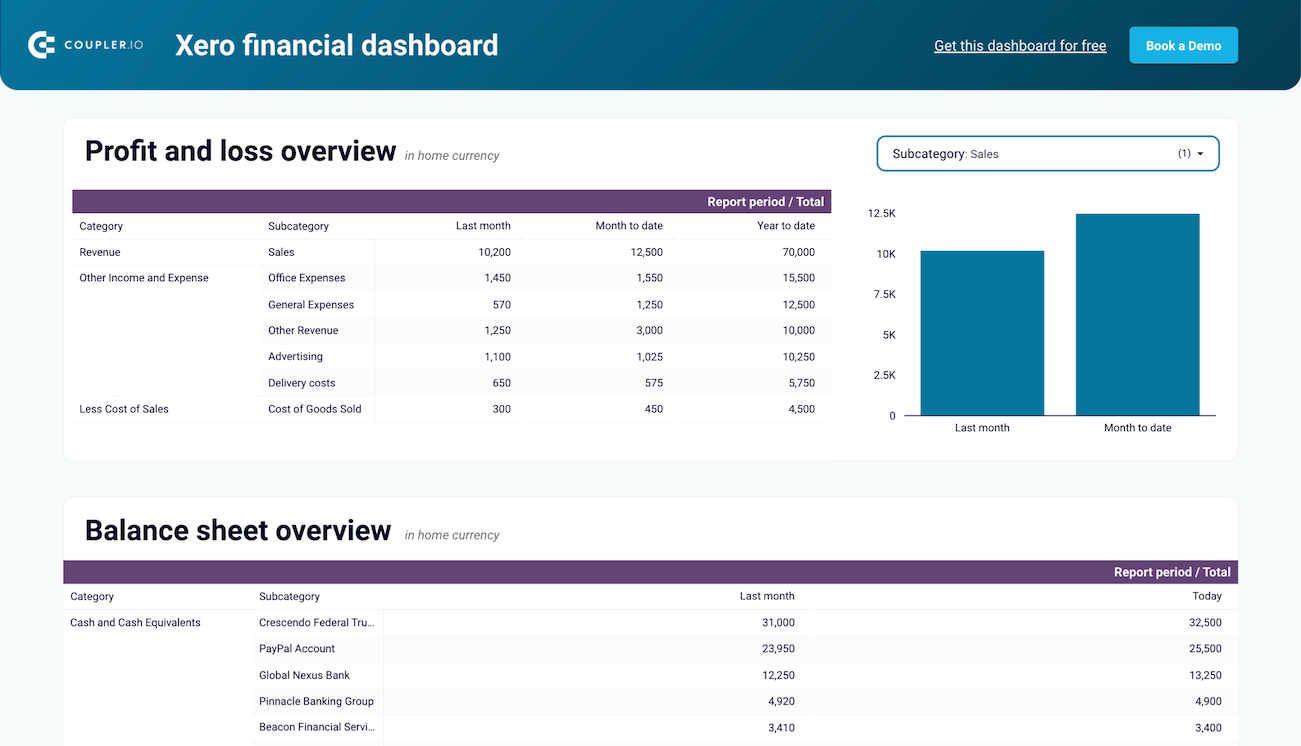

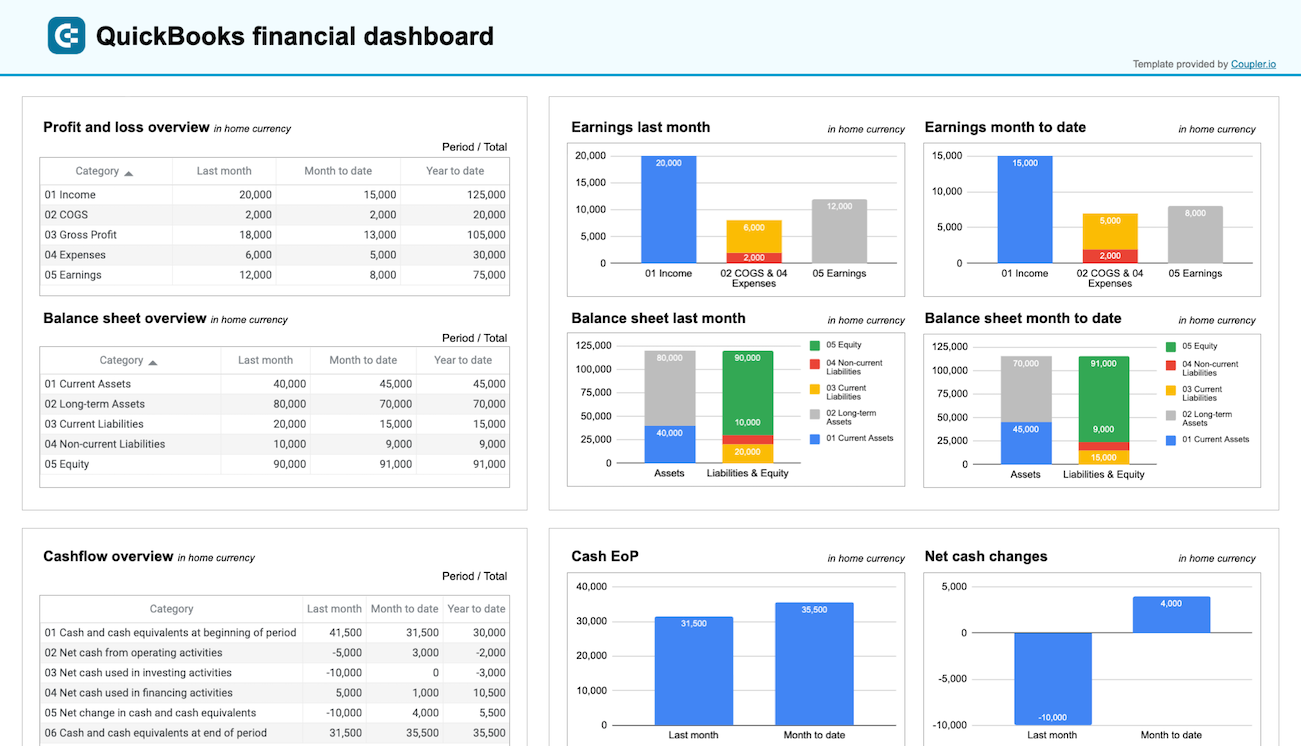

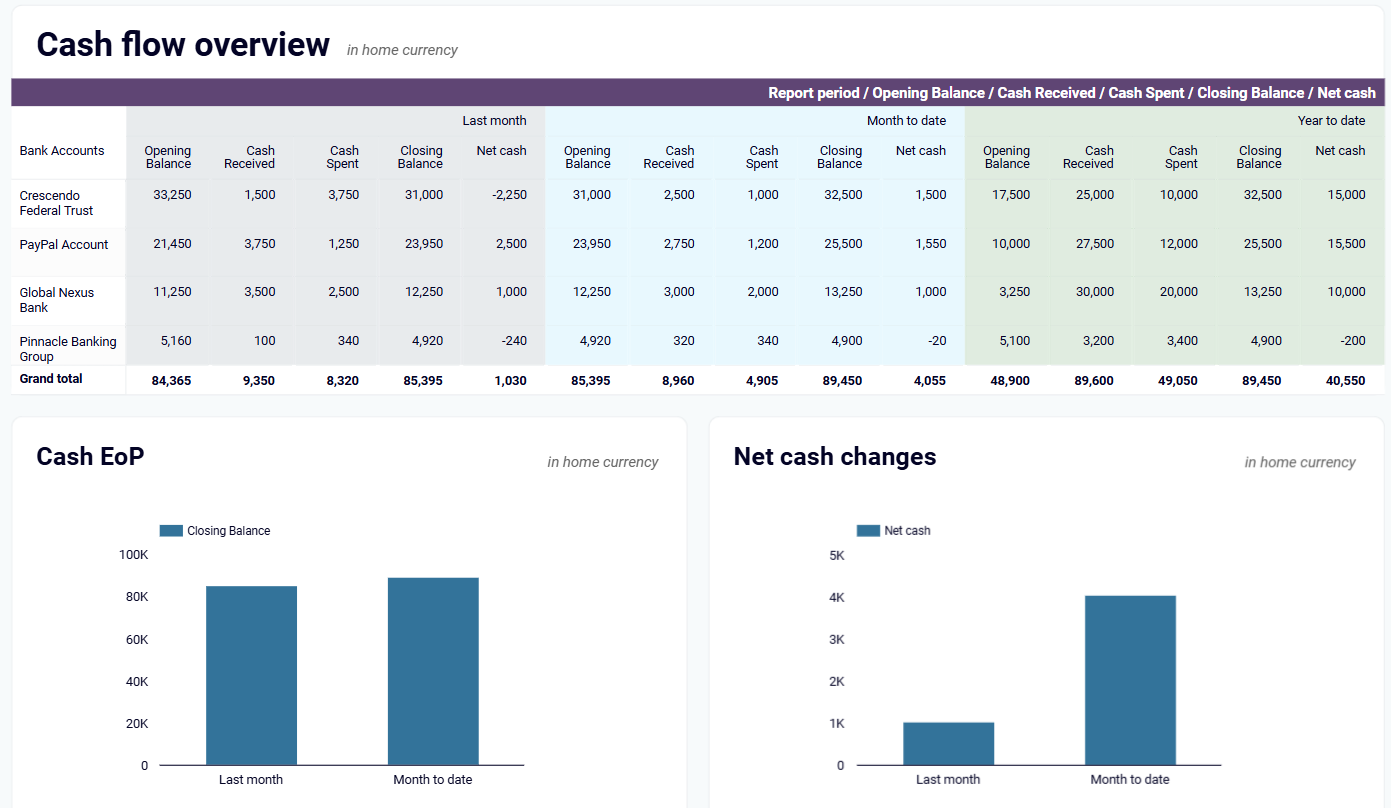

The financial report delivers critical performance monitoring through profit and loss overviews comparing revenue against expenses across multiple time periods. It includes balance sheet visualizations with clear assets versus liabilities comparisons and cash flow monitoring showing movements across all bank accounts. These insights provide the core financial metrics that drive strategic decision-making.

The accounts receivable report shows outstanding customer payments by time periods (current, 1-30 days, 31-60 days, 60-90 days, and 90+ days). It includes visualizations of unpaid invoices by customer, historical payment tracking, and collection priority indicators. These insights are vital for optimizing cash inflows and managing customer relationships effectively.

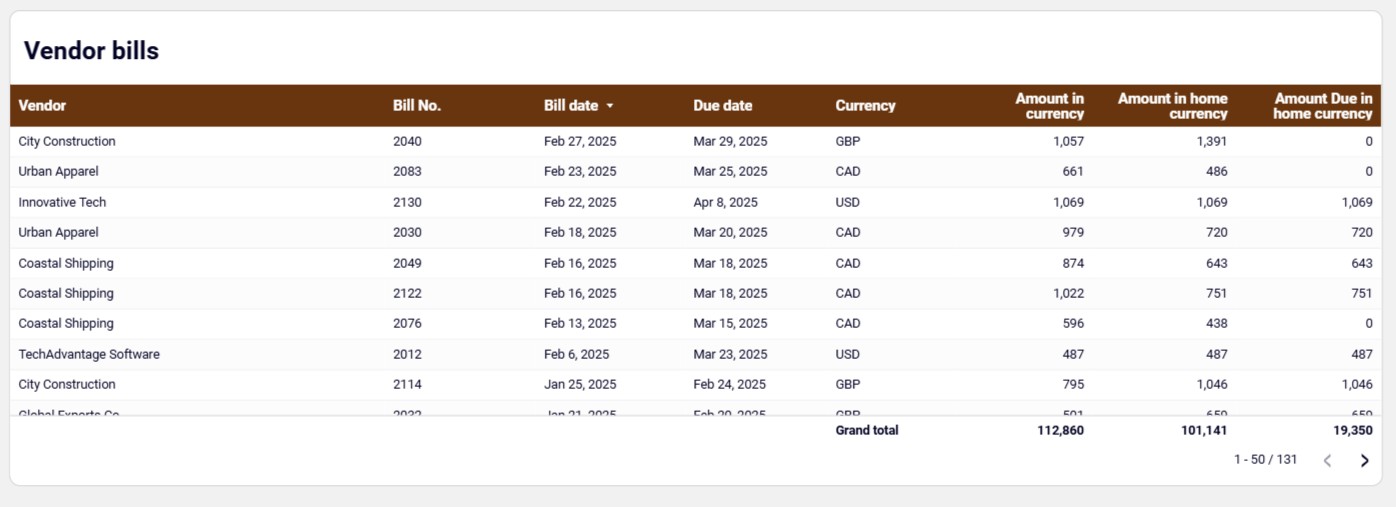

The accounts payable report provides vendor analysis with clear visibility into current and overdue bills. It includes aging information highlighting payment priorities, vendor contribution tracking, and bank account summaries to ensure sufficient funds for obligations. This report helps maintain vendor relationships while optimizing payment timing based on your cash position.

What insights you can get with the CFO dashboard

A detailed breakdown of outstanding customer payments categorized by aging periods allows you to quickly identify which customers have overdue invoices and the specific amounts in each aging category (current, 1-30 days, 31-60 days, 60-90 days, and 90+ days). The dashboard highlights top customers by unpaid amount, allowing you to prioritize collection efforts based on value and risk. This insight is crucial for maintaining healthy cash flow and reducing the risk of bad debt.

The vendor bills section provides a comprehensive historical view of all your bills over the past 12 months. This detailed table includes both paid and unpaid bills across all currencies. With its help, you can track payment history, identify spending patterns, and analyze vendor relationships over time. Each entry contains essential details like bill number, date, due date, currency, and amount, giving you complete visibility into your payment obligations and history. This long-term perspective is helpful for vendor negotiations, budget planning, and identifying opportunities to optimize payment terms.

The revenue section tracks both paid and unpaid invoices across multiple time periods, showing trends in income from both monthly and yearly perspectives. Visualization of your top customers by revenue contribution helps identify which clients drive the largest portion of your business, enabling targeted account management strategies.

The cash flow overview provides clear visibility into your organization's liquidity position across all bank accounts. You can track opening balances, cash received, cash spent, and closing balances for each account, with breakdowns by currency where applicable. The dashboard visualizes net cash changes over time, enabling you to identify trends, forecast future positions, and make informed decisions about timing for expenses, investments, and financing activities. This real-time insight helps prevent cash gaps before they occur.

How to create a CFO dashboard?

Metrics you can track with the CFO dashboard

Monitor the total value of outstanding customer invoices in real time, with breakdowns by customer and aging period. The CFO dashboard visually highlights which clients represent the largest portions of your accounts receivable, enabling focused collection efforts and better cash flow forecasting. This metric is essential for understanding how much revenue is in the pipeline but not yet realized as cash.

Track unpaid customer invoices categorized by specific overdue periods (30-day, 60-day, 90-day, and 90+ days). The dashboard displays this metric in both summary tables and detailed listings, allowing you to identify at-risk receivables that require immediate attention. This insight is crucial for managing collection priorities and maintaining healthy cash flow by addressing potential bad debt before it impacts your financial position.

Monitor your outstanding payment obligations to vendors in real time, with breakdowns by supplier and amount. The CFO KPI dashboard displays your top vendors by unpaid amount, helping you understand where your largest payment obligations lie. This visibility is essential for planning cash outflows and managing vendor relationships effectively while avoiding late payment penalties.

Visualize vendor bills that are past due, categorized by specific time periods (30+ days, 90+ days). The dashboard presents this information in both summary tables and detailed listings, allowing you to prioritize payments and manage cash outflows strategically. This metric helps prevent disruptions to your supply chain while optimizing payment timing based on your cash position.

Track your business's income patterns with month-by-month revenue analysis over a 12-month period. The CFO dashboard presents this data through intuitive line charts showing paid, overdue, and open invoices over time. This metric helps identify seasonal variations, growth trajectories, and potential issues in your revenue stream, providing essential context for forecasting and decision-making.

Monitor your net income by comparing revenue against expenses for multiple time periods (last month, month to date, and year to date). The dashboard displays profit and loss metrics in both tabular and visual formats, making it easy to assess profitability trends and identify areas requiring attention. This comprehensive view helps you understand the relationship between sales activities and cost management.

Visualize revenue distribution across your customer base with clear breakdowns of each client's contribution to your total income. The dashboard presents both a ranked list of top customers by revenue and pie charts showing percentage contributions to overall sales. This insight enables targeted account management, helps prioritize relationship-building efforts, and informs customer retention strategies.

Track cash movements through your business with visualizations of cash balances across all accounts, including opening positions, cash received, cash spent, and closing positions. The dashboard highlights net cash changes over reporting periods, enabling you to monitor liquidity and ensure adequate cash reserves for operations and investments. This real-time visibility is crucial for preventing potential cash shortfalls before they impact your business.