Accounts receivable dashboard examples and reporting templates

The accounts receivable dashboard template provided by Coupler.io is a ready-to-use reporting solution designed in Looker Studio. Check the enclosed instructions for using pre-built connectors for QuickBooks or Xero. See how your dashboard gets populated with the recent data on all your invoices.

Accounts Receivable dashboards for every need

about your case. It doesn't cost you a penny 😉

Choose your accounts receivable dashboard template to kick off

What is an accounts receivable dashboard?

With the accounts receivable dashboard reporting, you get a complete snapshot of invoicing through such metrics as overdue amount, unpaid amount, and others. They are illustrated graphically in easy-to-understand charts and tables. This tends to decrease the time to insights and accelerates strategic decision-making. All these findings can also be easily shared with stakeholders and colleagues.

What reports should be included on a meaningful accounts receivable dashboard?

Accounts receivable dashboards provide a number of charts and other visuals that clearly illustrate the state of accounts receivable for your company. It displays a 360-degree view of invoices, both paid and unpaid. You can apply filtering and sorting on the entire dashboard or to certain graphs to get a more narrow view of accounts receivable. Use this dashboard for customer payment profile analysis, financial planning, and detecting seasonal payment trends.

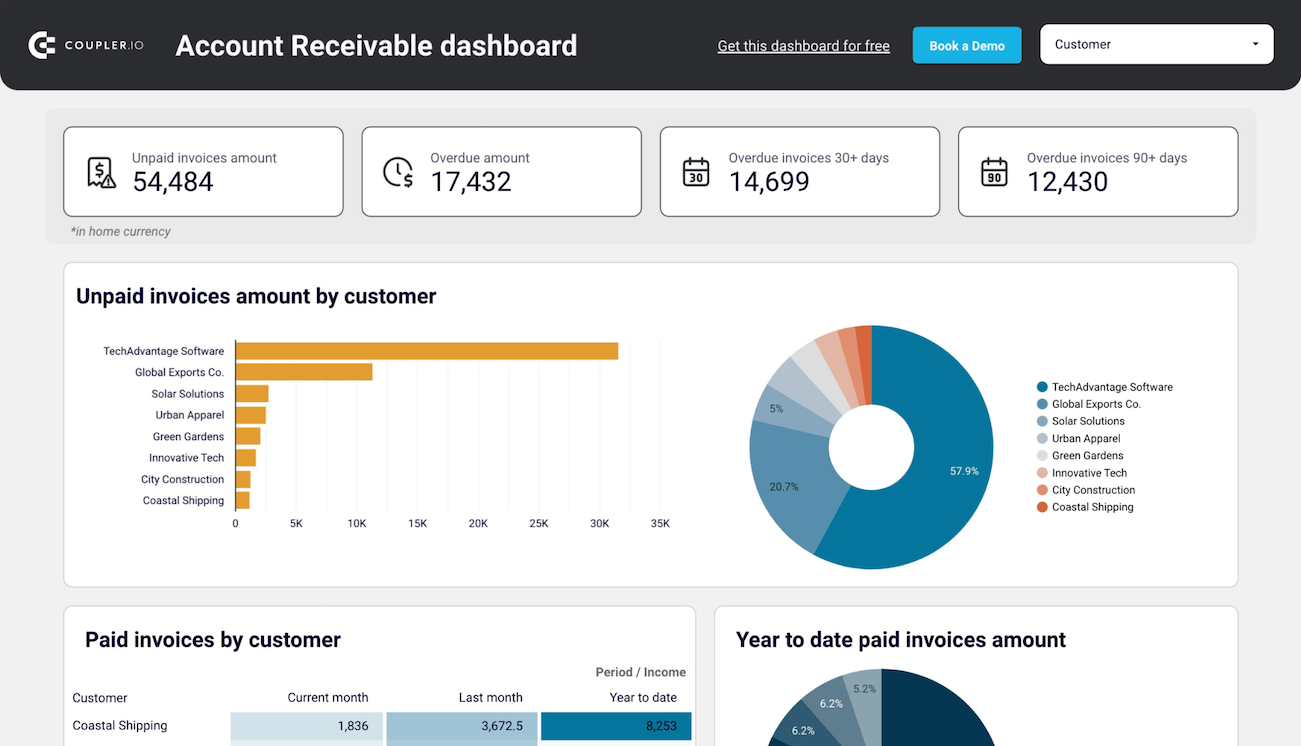

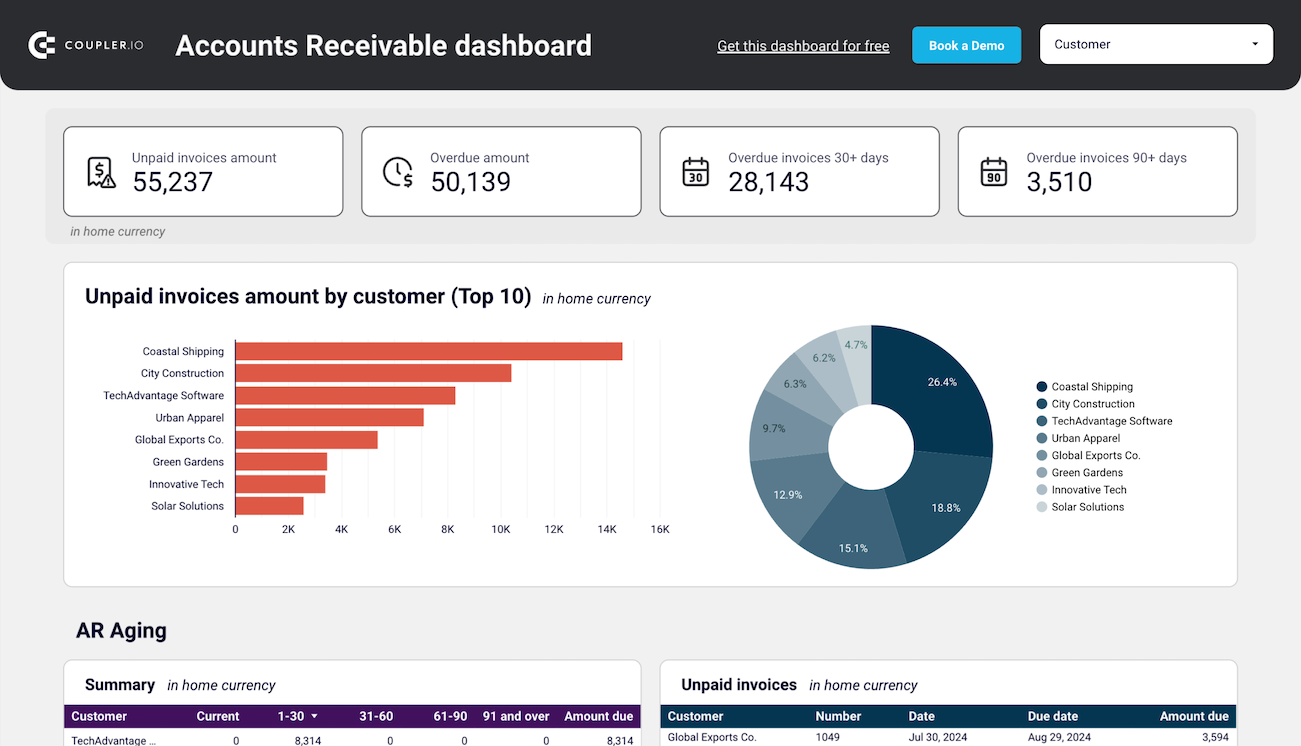

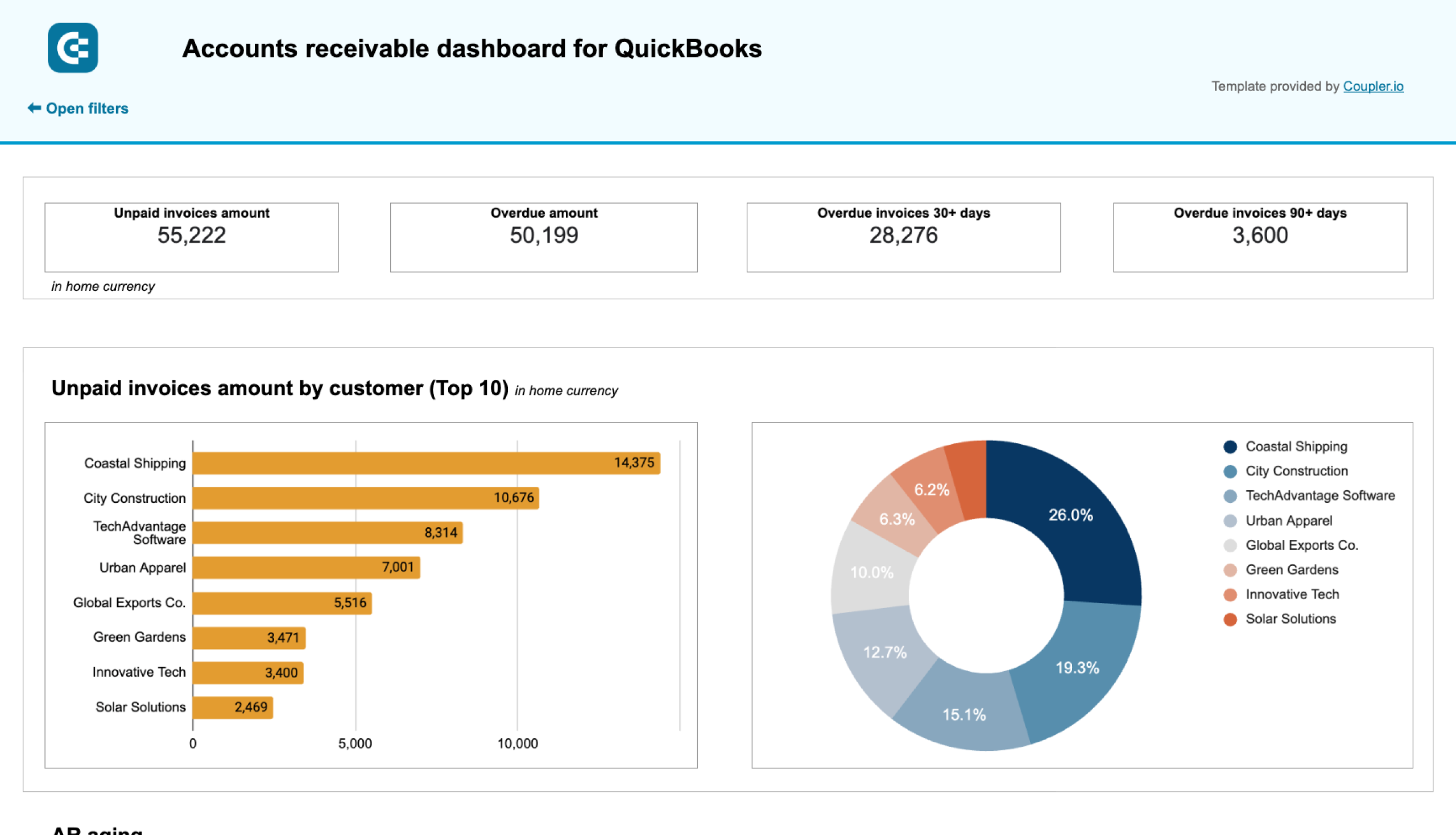

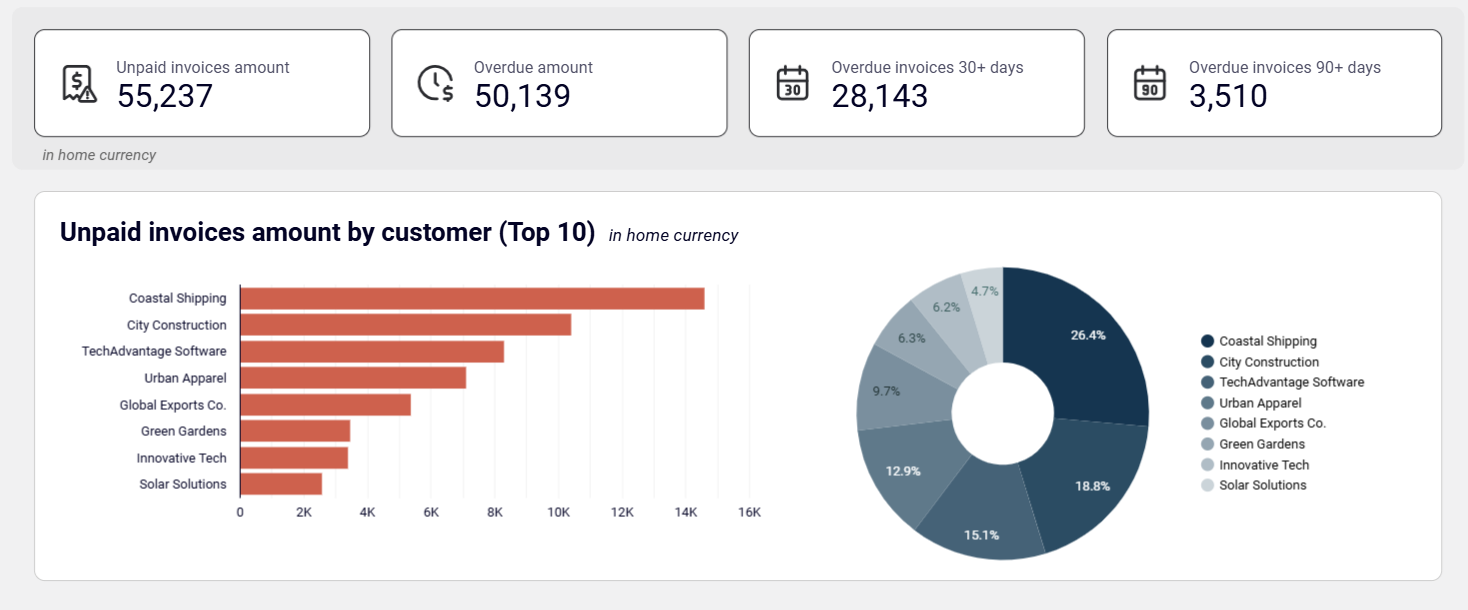

The dashboard contains a bar chart and a donut chart showing the distribution of unpaid invoices for each customer. It lets you see the major debtors with high unpaid amounts for the selected reporting period. You can also assess your clients based on their shares in the accounts receivable. Distribution of unpaid invoices helps you prioritize debt repayment activities.

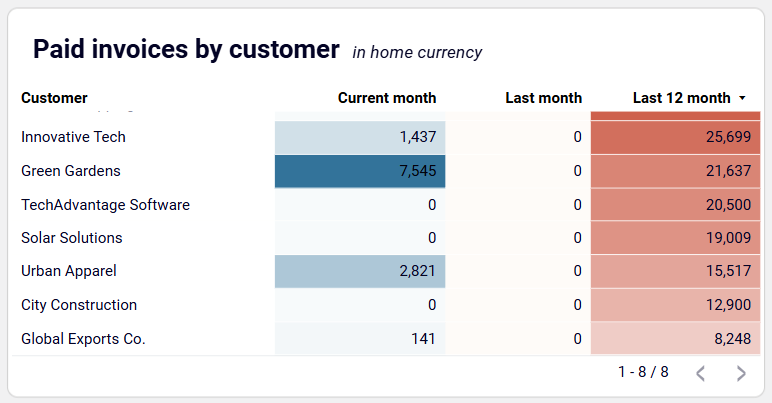

On the dashboard, you can see the value of paid invoices for each customer for the selected reporting period. It shows how much money each client paid the current month, the previous months, and the total amount paid during the current year. Such breakdown of paid invoices helps to analyze the fidelity and trustworthiness levels of each customer. Use this information to develop loyalty programs and individual collaboration strategies for your customers.

A histogram chart showing the correlation of paid and unpaid invoices for the last 12 months is one of the dashboard’s key reports. You can observe a share of both paid and unpaid invoices for each month. Track the dynamics of paid invoices to detect seasonal changes in payment habits and debt repayment. Monitor how the unpaid invoice amount changes from month to month to grasp the impact of sales strategy on the customer debt amount.

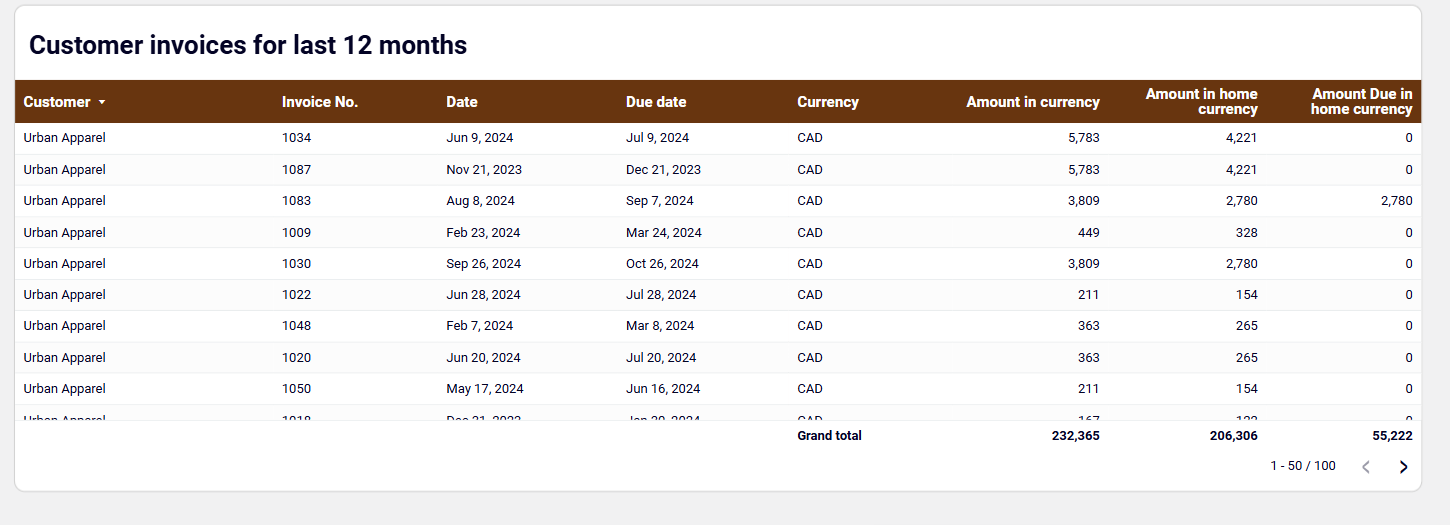

The accounts receivable KPI dashboard contains a table chart with a detailed breakdown of all invoices. It provides the due date, currency, and other essential details for each invoice. You can sort all the invoices based on the selected criteria to get the desired overview. Whatever your intent in deriving insights, you get a unified view of all invoices without the need to create individual reports.

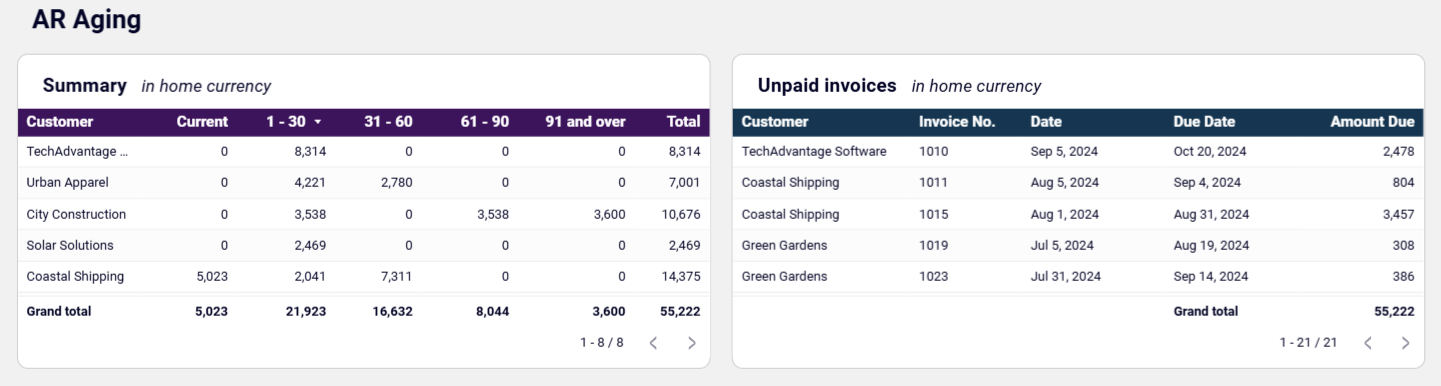

This dashboard presents the distribution of all overdue invoices for clients. It also allows you to find invoices with past due dates under 30 days and those over 90+ days. Detect customers who have the highest unpaid amount for overdue invoices. Based on these findings, decide who should be addressed first regarding debt repayment.

What insights you can get with the accounts receivable dashboard

This dashboard provides the unpaid invoice amount for each client. It also includes the donut chart showing the share of each customer’s unpaid invoices in the landscape of accounts receivable. Therefore, you can detect your major debtors and develop strategies for addressing them.

This dashboard provides a list of companies with their respective paid invoices. You can observe the total amount of paid invoices for each client for the current month, previous months, and the last year. These numbers reflect the most promising clients who make regular payments and sustain fruitful collaboration with your business.

This dashboard presents the distribution of all overdue invoices for clients and periods. Find the list of customers associated with the highest value of overdue amount and those with invoices with over 90 days deadline. Use this information to decide which customers should be addressed first regarding debt repayment.

This dashboard provides a complete overview of all your invoices for all customers in one consolidated view. For your convenience, it's possible to sort them by client, amount, currency, and due date. Arrange them using the available criteria to manage invoicing profiles in one place without the need to create several separate dashboards.

How to create an accounts receivable dashboard?

Metrics you can track with the accounts receivable dashboard templates

Each invoice has an associated sum of money in the selected currency. The unpaid amount shows the total value of invoices with the due date in the near future. Use this data to plan your expenses, allocate a budget, and perform general financial planning.

This number reflects the total value of invoices with the past due date. Keep an eye on the overdue amount to understand how often to send payment reminders and address clients regarding their debts. Compare the overdue amounts over different accounting periods to track the dynamics of unpaid invoices.

Overdue invoices reflect the monetary value of all the invoices with the deadline passed 30 days ago and earlier. Compare this value with the total unpaid amount to determine the share of such invoices in the overall accounts receivable landscape. Get a detailed overview of overdue invoices in the table to see which clients they correspond to.

This number shows the total sum of money in the selected currency for the unpaid invoices with a deadline of over 90 days. Evaluate these invoices and see whether the corresponding debts are collectible or not. Develop communication strategies for addressing these customers regarding debt repayment.